Fishery sector in 2021 and susceptibility to Covid-19 epidemics

Jun, 29 2021

VASEP forecasts that seafood exports can grow 10% year-on-year and reach $ 9.4 billion in 2021, of which, growth motivation from shrimp and pangasius

According to the analysis group of SSI Securities, the seafood industry is highly sensitive to pandemic because: disruption of global supply chains creates both opportunities and challenges; and Average selling price decreased due to lower demand, especially in restaurants.

VASEP forecasts that seafood exports can grow 10% over the same period and reach $ 9.4 billion in 2021 (higher than the average growth rate (CAGR) for the 2016-2019 period of 6.8%). , of which shrimp exports were still the growth engine (+ 15% over the same period reached US $ 4.4 billion), followed by pangasius (+ 5% over the same period reached US $ 1.6 billion) and other other aquatic products (+ 6% over the same period reached 3.4 billion USD).

However, SSI believes that such strong shrimp export growth is unlikely to be feasible, as the recovery of supply (India) after Covid-19 may inhibit the growth of Vietnamese shrimp exports. It will be difficult for shrimp exporting companies to re-establish the growth achieved in 2020 in the face of competition from India.

Also note that the shrimp farming cycle is short (only 3-4 months), and it is estimated that competition with India in the US and EU markets (which contributes 37% of the export value of Vietnamese shrimp) will become fierce. more in the second half of 2021.

However, export companies certified by the Aquaculture Stewardship Council (ASC) may see more opportunities to expand in the EU market as the EVFTA goes into effect throughout the year. Average selling price can increase as demand increases, helping to improve gross margin.

For pangasius, the analyst team estimates that a recovery in both volume and average selling price will drive export growth throughout the year, especially in the second half of 2021 when the vaccine is widely available. more widely in the US and EU, this can encourage consumption of seafood in the restaurant channel.

The issues and risks in 2021 can be seen as the possibility that the US may impose tariffs on seafood products imported from Vietnam, following the USTR Section 301 investigation on monetary policy. The entry potential of Nam Viet Joint Stock Company (ANV: HSX) into the US market may cause competitive pressure in this key export market. In 11M2020, the US accounted for 33% of VHC's total revenue.

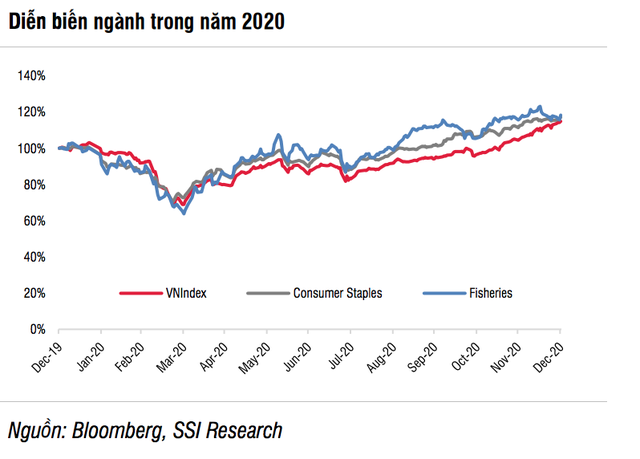

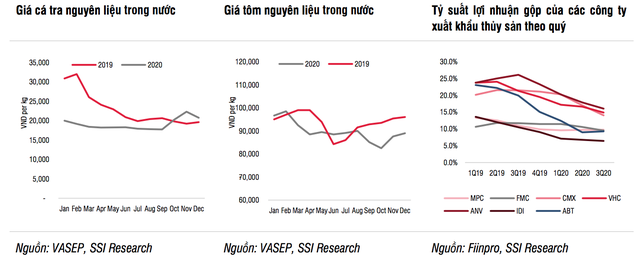

Looking back to 2020, the fisheries sector has undergone a structural change after the Covid-19 epidemic. The global supply chain is interrupted for the whole year. World demand has fallen dramatically for seafood products, causing prices to fall to new lows. The domestic raw shrimp price hit a bottom of 82,500 VND / kg in October (-12% YoY and -14% YTD) while the domestic material fish price dropped to 17,750 VND / kg (- 14% over the same period and -10% compared to the beginning of the year). It is noteworthy that this decline occurred even above the previous year's low. Despite the declining demand, shrimp exporting companies still find opportunities from the weakening of global supply and boosting exports in terms of output. According to Rabobank, India's shrimp production is estimated to decrease by 10% -15% year-on-year in 2020, creating opportunities for other countries to capitalize on the increase in exports.

On the other hand, export demand for pangasius has plummeted due to regional social gaps implemented in all major pangasius export markets. This not only affects the value of exports to China, the leading pangasius import market, but also affects both the US and EU markets (the second and third largest markets of Vietnam).

The total export value of Vietnamese seafood companies in the first 11 months of 2020 is 7.7 billion USD (-2% over the same period). By product type, shrimp export value reached 3.4 billion USD (+ 11% over the same period) and pangasius export value reached 1.4 billion USD (- 25% over the same period). Despite strong growth in shrimp export value, low average selling price makes gross profit margin of shrimp exporting companies decrease.

Pangasius exporting companies also recorded a drop in gross profit margin until Q3. However, as shrimp and pangasius prices started to increase from the beginning of Q4, SSI expects a higher gross margin at all. export companies, starting in the fourth quarter of 2020. VASEP estimated that seafood export value by the end of the year was flat over the same period last year (reaching 8.6 billion USD), of which shrimp export value reached 3.8 billion USD (+ 12.4% compared to that of the same period) and pangasius export value reached USD 1.5 billion (-24% over the same period).